2024 Irs Schedule 1 Instructions Meaning – The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 /EINPresswire.com . Page 3. Internal Revenue Service. “Instructions for Form 9465, Installment Agreement Request.” Pages 1-2. Internal Revenue Service. “Instructions for Form 9465, Installment Agreement Request.” .

2024 Irs Schedule 1 Instructions Meaning

Source : www.irs.govForm 2106: Employee Business Expenses: Definition and Who Can File

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.govAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.govWhat is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govPaul D. Diaz, EA, MBA on LinkedIn: Congress hasn’t made changes to

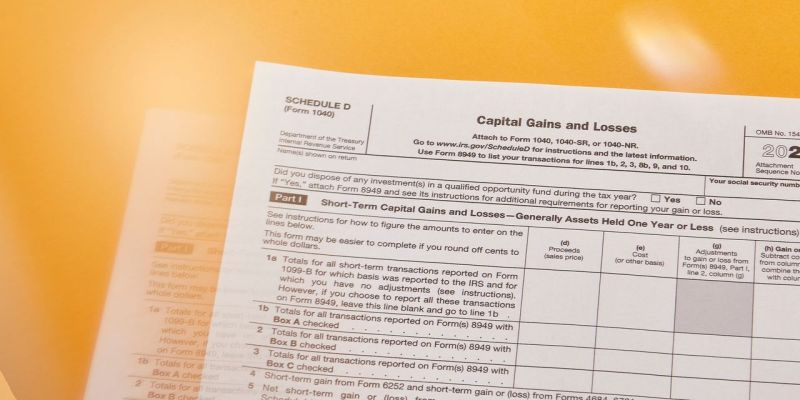

Source : www.linkedin.com2024 Irs Schedule 1 Instructions Meaning 1040 (2023) | Internal Revenue Service: Tax season is the period of time, generally between Jan. 1 and April 15 of each year Your accountant will have a more flexible schedule and will probably be able to start working on your . Schedule D Capital Assets The Schedule D form tells the IRS when a capital asset was sold, which is vital for calculating the tax owed on profitable investments. The IRS definition of capital .

]]>

:max_bytes(150000):strip_icc()/Screenshot2024-01-12at4.04.42PM-6ae67168a2a848849de8750450dab1af.png)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)